20 May The impact of early withdrawal from your super

Early access to super – important considerations

This is an exceptionally difficult time for many people. Accessing some of your super savings may help you to make ends meet until your circumstances improve. If you’re eligible, you may be able to make an application to withdraw up to $10,000 before 30 June 2020 and another application for a second withdrawal of up to $10,000 from 1 July 2020 to 24 September 2020.

Before you do, it’s important to consider:

• other benefits and concessions that may be available to you to help make ends meet

• the impact on retirement savings

• the impact on other benefits in super, such as insurance, and

• minimum account balance requirements.

How early withdrawals add up

- Many people have lost their jobs and there is much uncertainty around the depth and duration of the current crisis. Governments and policymakers across the globe have announced unprecedented fiscal and monetary packages to provide some offset to the downturn.

- The Australian federal parliament has approved the JobKeeper payments, boosted JobSeeker payments, and allowed the unemployed and people whose hours have been cut by 20 per cent to dip into their retirement savings.

- People are able to access up to $10,000 of their super, tax free, before 1 July, and then another $10,000 after the new financial year begins, also tax free.

- While some people will use all of the support available to make ends meet, others may have a choice, so what to do?

- Withdrawing superannuation funds now means an investor selling part of their portfolio in a depressed market, crystallising current losses and giving up the benefits of eventual recovery in investment markets. It will also erode the investor’s retirement wealth by forgoing future compound interest. Figure 1 shows what would happen to portfolio value if an investor moved out of equities at the trough of the GFC.

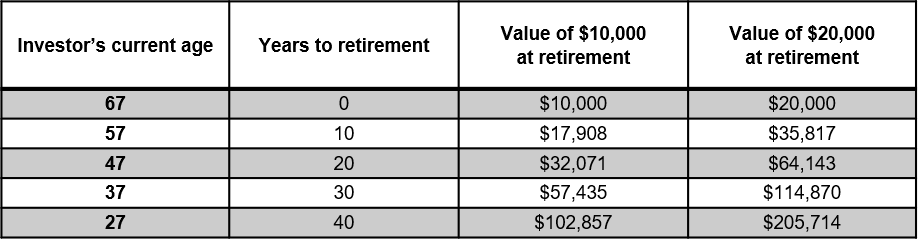

- Consider the impact that an early withdrawal could have on an investor’s superannuation balance. The calculations below are for a balanced multi-asset managed fund containing a mix of equities and fixed income, with an average net return of 6 per cent per annum.

- For an investor who has 20 years until retirement, the value of a $10,000 withdrawal is estimated to be worth $32,100 at retirement. Over the course of 40 years, the impact of the $10,000 withdrawal on the retirement savings climbs to $102,900, while a $20,000 withdrawal means an investor would have $205,700 less at their disposal. This could mean delaying their retirement for a number of years.

- Many people are currently doing it tough and will need to rely on the early access to superannuation as they don’t have another way to support their families. For investors who have a choice, taking a long term perspective may prove to be beneficial. The best thing investors can do is to stick to their investment principles and philosophy, and “stay the course” to have the best chance for investment success.

Comparing potential withdrawal impacts at different ages

Source: Vanguard

Source: Vanguard

Note: This is a hypothetical scenario for illustrative purposes only. All values are nominal. The calculations are for a balanced multi-asset managed fund containing a mix of equities and fixed income, with an average net return of 6 per cent per annum.

How to rebuild your super if you take early access

While your top priority at the moment is maintaining the cashflow you need to meet ongoing family and lifestyle expenses, there are some great ways that you may be able to boost your retirement savings in the future when your circumstances change. It may give you some peace of mind to know that you are able to make what might be a necessary decision today to access some of your super savings to assist you and your family at a difficult time, without compromising your retirement. In the future, even small, regular contributions could be important in getting your superannuation savings back on track for retirement as every little bit helps.

We have summarised below a path on how to review your rebuild your super. When your circumstances change and you have the opportunity to consider rebuilding your retirement savings, think about it as soon as possible. The sooner you start, the more chance you’ve got to ensure you can get your super savings back on track. However, please note this is general in nature and may not apply for everyone – for a strategy in line with your situation make sure you speak with your financial adviser.

Next Steps

If you would like to know more about your options regarding superannuation, meet with us to get you moving in the right direction.

This article was produced with reference to MLC and Vanguard (click here to view the article).

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments