01 Sep Tech Talk: Your guide to Superannuation

Superannuation Overview

Why invest in superannuation?

Superannuation is an investment environment designed specifically to help you save for retirement. Knowing what superannuation is and how it works can give you greater control and the confidence to make the financial choices that are right for your needs. For many, this will be the largest asset owned outside of your family home.

It’s worth taking an active interest in your super savings during your working years. It’s your money and your super’s investment performance over time will impact how much you eventually have in retirement.

The advantages of investing in assets in the superannuation environment include:

- Concessional tax treatment (maximum of 15%)

- Ideal form of savings for retirement

- Insurance benefits can be attached

- Government co-contribution incentive

- When in pension phase it is virtually tax free

Superannuation exists to help you provide for yourself in retirement rather than relying on social security. As a result, your superannuation savings cannot be accessed until a condition of release is met, such as retirement after reaching your preservation age or reaching age 65.

How is your money invested?

You can invest your superannuation funds in (almost) any asset class that you would otherwise invest with your personal savings like term deposits, shares, property etc. The only big differences is that when you invest in your own name you are subject to personal tax rates (up to 47% including medicare levy) whereas super is only taxed at a maximum of 15%.

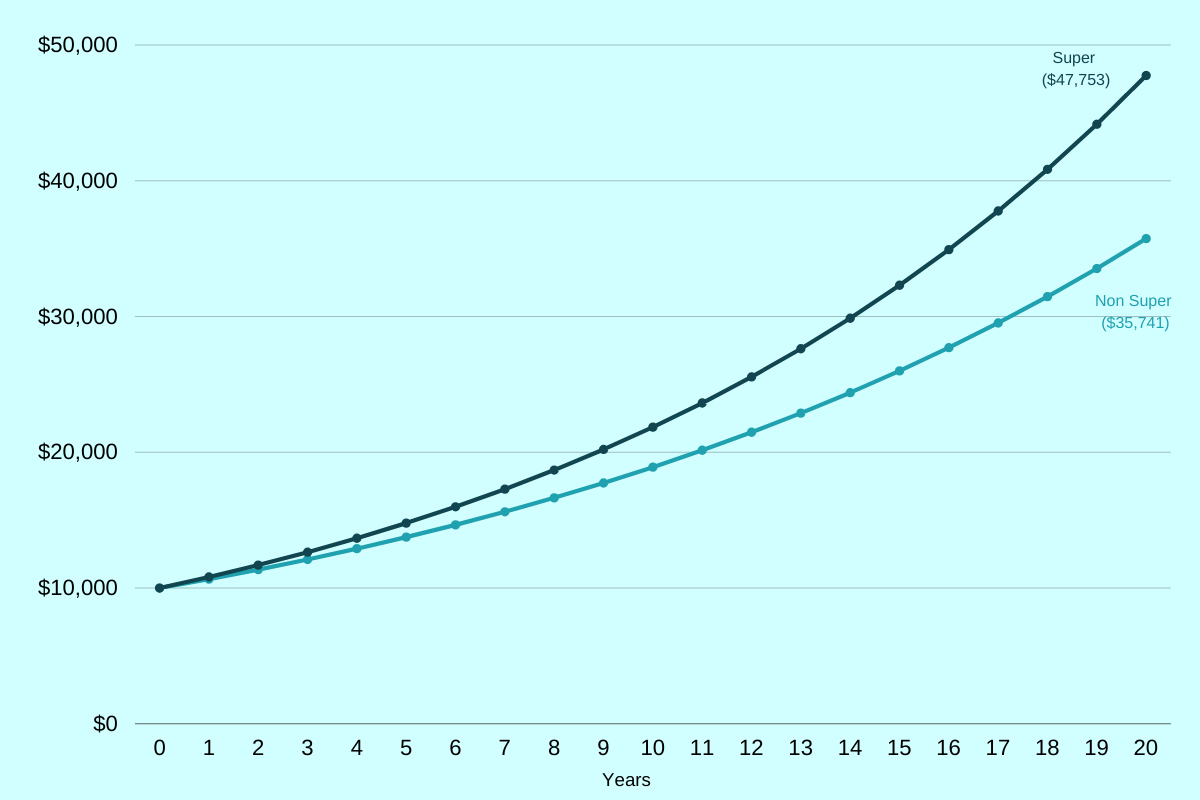

To illustrate this, assume you invested $10,000 in both your own name at the highest marginal tax rate of 47% and $10,000 inside super in the exact same investment in Australian shares. We will assume that the share price will increase by 4%pa and you receive dividends of 4%pa which you will reinvest each year. In 20 years time this $10,000 investment will be worth $47,753 in super and will be $35,741 if held in your personal name. This is one of the main reasons why super is the most attractive vehicle to save for retirement.

When saving for retirement, it is important to recognise that your investment timeframe is long term. For this reason, many experts suggest it is important to invest in an appropriate level of growth assets within a superannuation fund. While these types of assets (such as shares and property investments) are generally considered higher risk over the short to medium term, over the long term they will generally outperform other types of assets (such as cash).

Once approaching retirement, your investment timeframe becomes shorter and your tolerance of fluctuations in the value of your investment capital may become lower. Taking this into account, many investors shift some of their assets towards lower-risk asset classes such as cash and bonds when nearing retirement.

Superannuation Contributions

Who can contribute?

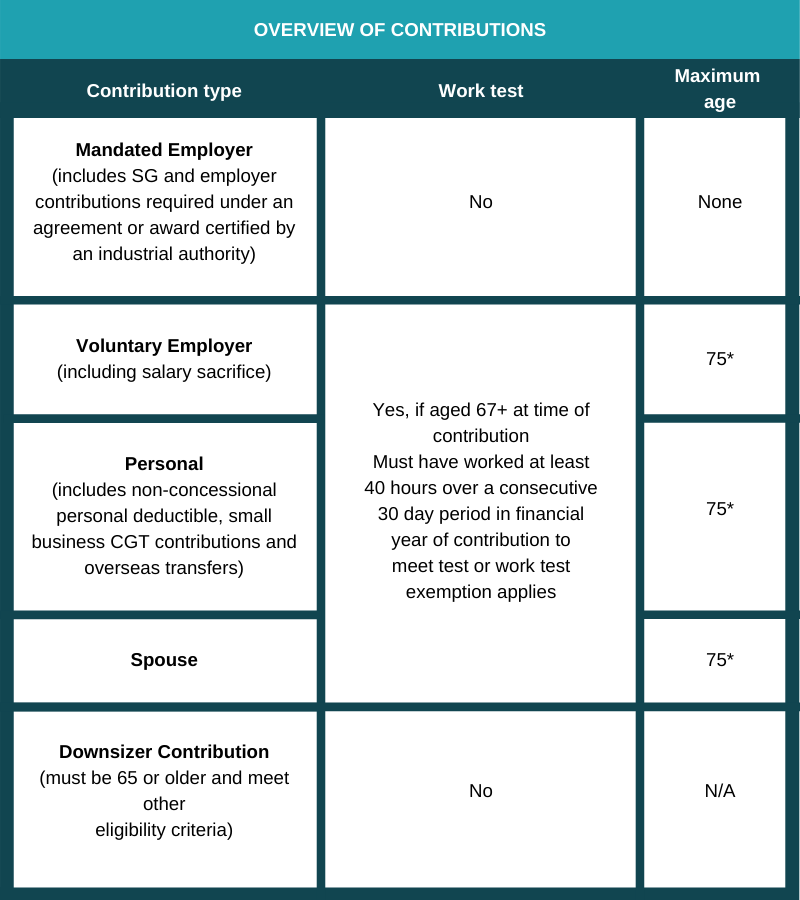

There are strict rules about who can contribute to superannuation and how much.

*Must be received within 28 days of end of month in which member reaches age 75.

*Must be received within 28 days of end of month in which member reaches age 75.

Work test exemption eligibility:

- May be applied only in the financial year immediately following year the individual last met the work test

- Individual’s total super balance is less than $300,000 on previous 30 June

- Can be only utilised once in an individual’s lifetime

Can be applied to both voluntary employer contributions and member contributions. These include salary sacrifice, personal deductible contributions, personal contributions, small business CGT contributions, and spouse contributions.

Concessional Contributions

Concessional Contributions (CCs) are contributions made for you or by you for which a tax deduction is claimed and are included in the assessable income of the fund. Concessional Contributions form part of the fund’s assessable income and are taxed concessionally at 15%.

Concessional Contributions include:

Superannuation Guarantee

Employers are legally required to provide a minimum level of superannuation support for their employees each financial year. The current superannuation rate is set at a minimum of 9.5% p.a. of ordinary time earnings. It is important to determine if your employer includes this 9.5% within your total employment package or if it is paid on top of your cash salary.

Your employer can claim tax-deductions for contributions to superannuation on your behalf.

Salary Sacrifice

Salary sacrifice is a voluntary agreement between you and your employer to pay some or all of your pre-tax salary into your super fund. This reduces your assessable income, which may also reduce your marginal tax rate. By contrast investing in superannuation (or other assets) after receiving your salary means you would already have paid tax (at up to the maximum marginal tax rate of 45% plus Medicare Levy) depending on your income.

Personal Deductible contributions

There are specific requirements (including timing) that must be met in order to a claim a tax deduction for personal contributions to super. It is strongly advised that you consult with your tax agent, accountant or financial planner around these requirements if you intend to claim a tax deduction for any personal contributions to super.

Amounts which are not counted towards the CC cap include:

- The taxable amount of an overseas super transfer that you elect to have taxed within your Australian superannuation fund

- Any untaxed elements of a rolled over superannuation benefit.

Exceeding the Concessional Contributions cap

These are contributions that are in excess of the CC cap. Whilst there is generally no limit on the level of concessional contributions you can make in a financial year (subject to age requirements), penalty tax can be imposed if your total CCs for the financial year exceed the CC cap. The general CC cap for the 2019/20 financial year is $25,000. Since 1 July 2018, individuals may accrue unused concessional contribution cap amounts over a five-year rolling period, with the first opportunity to use these commencing from 1 July 2019. To be able to use the ‘catch up’ amount, an individual’s total super balance must be below $500,000 on 30 June prior to the commencement of the financial year in which they are to be used.

Individuals who exceed the concessional contribution cap will have the excess included in their assessable income and taxed at their marginal tax rate less a 15% non-refundable tax offset. An interest penalty will also apply. If the member chooses to retain the excess inside their superannuation fund the amount will count toward their non-concessional contribution cap.

Non-Concessional Contributions

Non-Concessional Contributions (NCCs) are contributions that are not assessable to the fund. Your superannuation fund can only accept NCCs if you have quoted your tax file number to the fund/trustee.

Amounts which are counted towards the NCC cap include:

Personal post tax contributions

These are contributions paid into your super fund for which you do not or cannot claim a tax deduction. Any personal post tax contributions made are tax free on entry to, and exit from, your fund.

Spouse contributions

These are contributions made by one spouse on behalf of another. Eligible spouse contributions are treated like personal post-tax contributions. However, a tax offset of up to 18% (up to $540) may be claimed by the contributing spouse on contributions up to $3,000. To be eligible for the full tax offset, the recipient spouse’s assessable income, Reportable Employer Super Contributions (RESC) and Reportable Fringe Benefits (RFB) must be below $37,000 in the financial year, and the contribution must not cause exceed the recipient spouse’s non-concessional cap.

Exceeding the Non-Concessional Contributions cap

Like concessional contributions, there is generally no limit on the amount of NCCs you can make/receive in a financial year (subject to meeting age requirements). However penalty tax may be imposed where the level of your NCC exceeds your NCC cap.

To be eligible to make a NCC, firstly your total super balance must be less than $1.6 million on 30 June of the previous financial year. The standard NCC cap is $100,000 pa. However, if you are 64 years old or less on 1 July and you have NCCs for the year in excess of $100,000, a two or three year average (or bring forward) rule will apply which increases your NCC Cap to $200,000 (if your total super balance was between $1.4 million and $1.5 million) or $300,000 (if your total super balance was less than $1.4 million). However that higher limit applies to the total of all NCCs made in that and the next one or two financial years.

NCCs in excess of your relevant NCC cap can attract extra tax. The tax is levied on you (the member) and you are required to withdraw the funds from your superannuation to pay the tax. However individuals have the option of withdrawing excess contributions made from 1 July 2013 plus associated earnings with those earnings only taxed at the individual’s marginal tax rate.

Amounts which are not counted towards the NCC cap include:

- Contributions made from personal injury payments.

- Amounts made under the small business capital gains tax concessions within the CGT cap contribution limit.

- Downsizer contributions.

Government co-contributions

You may be eligible for a Government superannuation co-contribution if you meet all of the following requirements:

- Your assessable income, RESC and RFB including any reductions for carrying on a business is less than $53,564

- You make a personal post-tax contribution to superannuation and this does not cause you to exceed your NCC cap

- 10% or more of your assessable income, RESC and RFB is from eligible employment or carrying on a business or a combination of both

- You lodge a tax return for the financial year

- You are under 71 years of age at the end of the financial year

- You do not hold a temporary visa.

The Government will boost your retirement savings by making an additional contribution on your behalf at a rate of 50 cents for every $1 you put in, up to a maximum of $500. The maximum contribution reduces by $0.0333 for every $1 of assessable income, RESC and RFB above $37,697 and will cease when assessable income, RESC and RFB reaches $52,697.

Low income superannuation tax offset

The low income superannuation tax offset (LISTO) can assist low income earners to save for their retirement.

If you earn an adjusted taxable income up to $37,000 you may be eligible to receive a refund into your superannuation account of the tax paid on your eligible concessional superannuation

contributions, up to a cap of $500.

You don’t need to apply for LISTO. If you’re eligible and your fund has your tax file number (TFN), we will pay it to your fund account automatically.

Contributions from the sale of small business assets

Contributions made under the small business capital gains tax concessions (for example on the sale of a small business asset) fall under a separate lifetime limit of $1,515,000 (indexed yearly).

In order to not count against the NCC cap, contributions under these rules must be accompanied by a capital gains tax election notice which is provided on or before making the contribution. Also, the contribution must generally be made before the taxpayer is due to lodge their tax return for the year the relevant asset was sold.

Under the 15 year exemption rules, proceeds from the sale of assets up to that limit can be contributed to superannuation, provided the member meets eligibility criteria (satisfy a work test or work test exemption if over age 65). No contribution can be made after age 75 (with the exception of some situations involving earnout arrangements).

Under the Small Business Retirement Exemption rules, a contribution of up to $500,000 (of the amount of capital gain a taxpayer has elected to disregard under the retirement exemption) can be made to super on behalf of the member. Contributions under the retirement exemption also count towards the $1,515,000 lifetime limit above.

Downsizer contributions

You may be eligible for a downsizer contribution if you meet all of the following requirements:

- You are 65 or older at the time you make the contribution

- You or your spouse sold a home (not a caravan, houseboat or mobile home) which has been owned by either/both of you for 10 years or more

- You are able to apply at least the part main residence exemption on the sale

- The amount is no more than the lesser of $300,000 per eligible individual or the capital proceeds from the sale

- The contribution is made within 90 days of settlement

- You provide your super fund with the approved from either before or at the time of the contribution

- You have not previously made a downsizer contribution as a result of the sale of another home

Personal injury payments

These are contributions made from personal injury payments arising from a structured settlement, an order for a personal injury payment or lump sum workers’ compensation payment which meets certain requirements.

Superannuation rollovers

These are superannuation benefits which are rolled over or transferred from within the superannuation system. Superannuation benefits rolled over from an untaxed fund are subject to a cap of $1,480,000 per fund. The untaxed element of the rolled over amount within the cap is subject to 15% tax within the fund. The amount above the cap is subject to excess rollover tax of 47% (including Medicare Levy) by the transferring superannuation fund and forms part of the tax-free component in the receiving superannuation fund.

By consolidating your superannuation, you may be able to save account fees and be better able to track how your retirement savings are performing. However, caution should be exercised as rolling over may have unintended tax and insurance consequences. It is a good idea to consult your financial planner before requesting a rollover.

Contribution splitting

Since 1 January 2006, superannuation contributions made for the benefit of a member may be split with a spouse (under certain conditions).

The contributions that may be split are either ‘taxed splittable contributions’ or ‘untaxed splittable employer contributions’.

Taxed splittable contributions

Taxed splittable contributions are concessional contributions.

The maximum splittable amount is the lesser of:

- 85% of the concessional contributions for the financial year

- The CC cap for the financial year.

Untaxed splittable employer contributions

Untaxed splittable employer contributions are contributions by the Commonwealth, State or Territory governments to a public superannuation scheme that are not included in the assessable income of the fund.

The maximum splittable amount is the lesser of:

- 100% of the concessional contributions for the financial year

- The CC cap for the financial year.

As a member of a superannuation fund, you can request a contribution split of splittable contributions made in either:

- The previous financial year

- The financial year in which your entire benefit is to be rolled over in that year.

Where, as a member, you wish to claim a tax deduction for amounts that are to be split with your spouse, you are required to provide your superannuation fund with a notice that the contribution will be claimed as a tax deduction prior to a contribution splitting application.

Otherwise, you will only be able to claim a tax deduction in respect of contributions that have not been split with your spouse.

Also, where you wish to rollover your benefit to another superannuation fund and split a contribution with your spouse, you must request the amount to be split prior to rolling over your benefit.

There are also restrictions on the receiving spouse. If your spouse is under preservation age (see later section), they may be able to receive a splittable contribution. Where your spouse has reached preservation age but is still under 65, your spouse must state that they have not met a retirement condition of release.

A spouse aged 65 or over cannot receive a splittable contribution.

The split contribution received by your spouse is considered a preserved benefit. That is, your spouse cannot access these amounts until they meet a retirement condition of release.

Superannuation taxation

Taxation of complying funds

To encourage Australians to invest in their retirement, the Government applies concessional tax rates to contributions (within allowable limits) and withdrawals from ‘complying’ superannuation funds – ie super funds whose trustees have chosen to be regulated as a complying fund. Most funds are complying funds and the information above is relevant to complying funds only.

Contributions tax

Assessable contributions which include concessional contributions and untaxed elements from a superannuation rollover are considered to be assessable income of the fund and taxed at the concessional rate of 15% if you earn under $250,000 pa (up from $300,00 prior to 1 July 2017). If you earn more than $250,000 per financial year, contributions to your super are taxed at 30%.

Investment‑ income

Whilst a member’s savings are in the accumulation phase of a complying superannuation fund, any investment earnings are considered assessable income of the superannuation fund and taxed at 15%. This includes any capital gains the fund has made from underlying investments. A 1/3rd discount applies to capital gains from assets that have been held for more than 12 months and therefore only 2/3rds of the capital gain is assessed and taxed at 15% (resulting in an effective tax rate of 10% on these capital gains).

Taxation of your superannuation member benefit

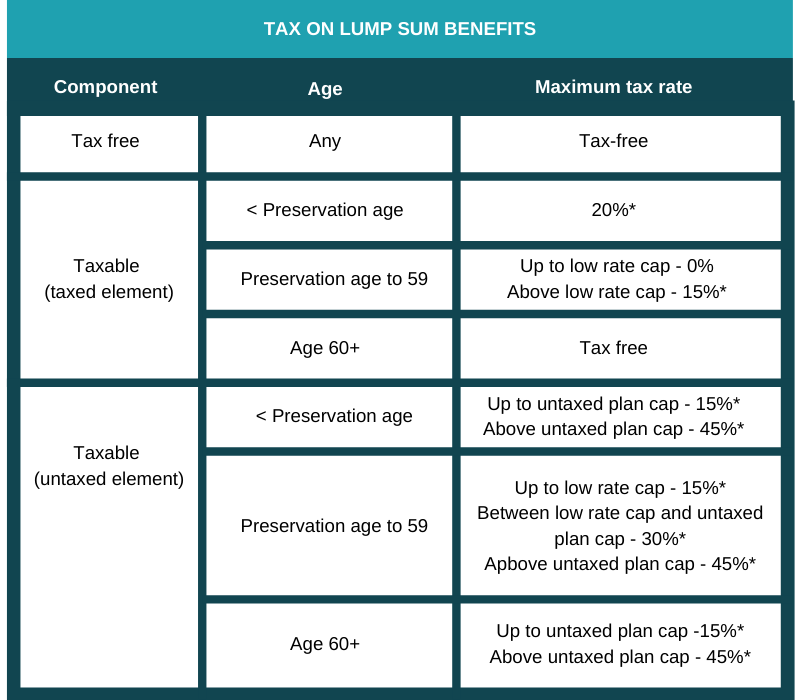

Your superannuation member benefit may comprise some or all of the following tax components:

- Tax free components

- Taxable components:

- taxed element

- untaxed element.

Tax free component

This consists of certain crystallised components of your superannuation benefit at 30 June 2007 plus NCCs, government co-contribution and low income contribution, certain proceeds from the sale of small business assets, personal injury payments, the tax free component of rollovers and amounts subject to excess rollover tax.

The tax free component is not subject to tax on withdrawal.

Taxable component

This is the balance of your superannuation member benefit less the tax free component. The taxable component is comprised of:

- an untaxed element

- derived from an untaxed source such as an untaxed superannuation fund (e.g. Government superannuation fund such as ComSuper).

- may be derived from a superannuation death benefit wholly or partly funded by insurance and the premium was claimed as a tax deduction

- a taxed element – derived from a taxed source e.g. a taxed superannuation fund.

*Plus Medicare levy

Low rate cap

Cap in 2020/21 : $215,000

Applies to:

- Total of all taxable components taken as a lump sum from preservation age up to age 59

- If a benefit includes both taxed and untaxed elements, it applies firstly to taxed element

Taxable benefits within low rate cap are included in assessable income in individual’s tax return, which may impact entitlement to Government tax benefits and concessions that are based on assessable or taxable income.

Untaxed plan cap

Cap in 2020/21: $1,565,000

Tax treatment of income stream benefits

The tax free component of any income stream benefit paid to you from a superannuation fund is 100% tax free. If you have reached your preservation age, but are under age 60, the taxed element of the taxable component of your benefit is assessable in full, but you are entitled to a tax offset equal to 15% of this amount. The untaxed element of the taxable component is assessable in full.

Once you turn age 60, any income stream benefits (other than the untaxed element) will be tax free. The untaxed element is assessable in full, but qualifies for a 10% tax offset.*

*If during a financial year you receive more than $100,000 from capped defined benefit income scheme(s).

–Half the amount in excess of $100,000 is included in assessable income (if tax-free component or taxable component element taxed)

–The amount in excess of $100,000 is not eligible for the 10% tax offset (if taxable component element untaxed).

Preservation

What does preservation mean?

Superannuation benefits are classified into three different preservation categories according to how accessible they are to a member, namely:

- Preserved benefits

- Restricted non-preserved benefits

- Unrestricted non-preserved benefits.

Preserved benefits

Preserved benefits must remain in the accumulation phase of a superannuation fund until a condition of release has been met (see later).

Note, however, that under the ‘transition to retirement’ measures, a member who has reached preservation age may be able to access their preserved benefits through a non-commutable income stream.

Restricted non-preserved benefits

Restricted non-preserved benefits generally include certain contributions made before 1 July

1999. They must remain in a superannuation fund until a condition of release has been met or

may be accessed under the ‘transition to retirement’ measures.

Restricted non-preserved benefits have an additional condition of release. Where a member has left employment with an employer who contributed to the fund on their behalf, all restricted non-preserved benefits in that fund become ‘unrestricted’ and can be accessed immediately.

Unrestricted non-preserved benefit

These consist of some or all of:

- Previously preserved or restricted non-preserved benefits where the client has satisfied a condition of release and no cashing restriction applies

- Employment Termination Payments (formerly known as Employer Eligible Termination Payments) rolled over to the fund before 1 July 2004

- Unrestricted non-preserved benefits rolled over to the fund

- Any earnings on the above three amounts for the period prior to 1 July 1999.

Generally, a member will have full access to unrestricted non-preserved benefits.

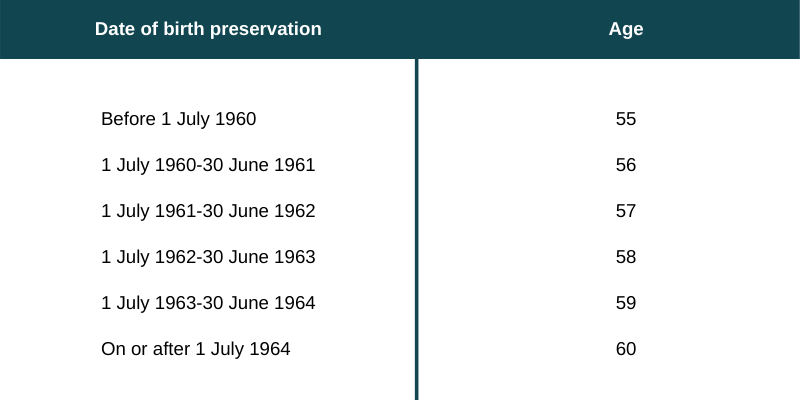

Preservation Age

Conditions of release

How can superannuation be accessed?

Preserved and restricted non-preserved benefits can be accessed in the following circumstances:

- Attaining the age of 65

- Retirement – which requires that:

- where the member has reached their preservation age:

- an arrangement under which the member was gainfully employed has come to an end

- the trustee of the superannuation fund is reasonably satisfied that the person intends

never again to become gainfully employed

- where the member has reached their preservation age:

- Where the member has reached age 60, an arrangement of gainful employment has ceased and either of the following circumstances apply:

- the person turned age 60 on or before the ending of the employment

- the trustee is reasonably satisfied that the person intends never again to become gainfully employed

- Termination of gainful employment after 1 July 1997

- where the benefit in a standard employer-sponsor fund at the time of termination is less than $200

- Permanent incapacity – where the trustee is reasonably satisfied that the member is unlikely, because of ill health, to engage in gainful employment for which they are reasonably qualified by education, training or experience

- Death

- Terminal illness – where a member suffers an illness, or has incurred an injury, that is likely to result in the death of the member within 24 months. Lump sum benefits paid in the event of terminal illness are tax free

- Compassionate grounds – a person may apply to the Australian Taxation Office for the release of benefits on compassionate grounds. Generally, compassionate grounds are where money is used to:

- Pay for medical treatment and transport for the member or a dependant

- Modify of a member’s principal place of residence or vehicle due to severe disability of the

member or a dependant - Pay for expenses associated with palliative care in the case of impending death

- Pay for expenses associated with a dependant’s palliative care, death, funeral or burial

- Prevent foreclosure or mortgagee sale of the member’s principal place of residence

- Compassionate grounds (Coronavirus) – until 31 Dec 2020, a person may apply to the Australian Taxation Office for the release of benefits of up to $10,000 per financial year to deal with the economic effects of COVID-19 if:

- They are unemployed,

- They receive certain Centrelink allowances such as the JobSeeker Payment etc

- One or after 1 January 2020, they were made redundant or their working hours reduced by

20% or more - If they were a sole trader, suffered a reduction in turnover by 20% or more, or

- For some temporary residents who cannot meet immediate living expenses

- Severe financial hardship – to meet this condition of release a trustee of a superannuation fund must be satisfied that the member is in severe financial hardship by either:

- Receiving written evidence from a Commonwealth department or agency, such as Centrelink, that the person is receiving and has received Commonwealth income support payments for a continuous period of 26 weeks. Further, the member needs to satisfy the trustee that they are unable to meet reasonable and immediate family living expenses

- The person has reached preservation age and based on written evidence from a Commonwealth department or agency that the person has been in receiving Commonwealth income support payments for a cumulative period of 39 weeks after

reaching preservation age

- Temporary incapacity – a superannuation fund may provide an income stream to a member as a temporary incapacity benefit

- Transition to retirement – when you reach your preservation age, you may be able to access your preserved and restricted non-preserved benefits through a variety of non-commutable

income streams.- This condition of release is commonly known as ‘transition to retirement’. A member cannot receive a lump sum under this condition of release until another condition of release has been met (eg, generally retirement or turning 65)

- Temporary resident departing Australia permanently. People who have been in Australia on a temporary resident visa that has expired or been cancelled may have access to their preserved benefits after they permanently depart Australia. Where a temporary resident accesses their superannuation benefit under this measure, it known as a Departing Australia

Superannuation Payment (DASP).- Australian and New Zealand citizens or permanent residents of Australia are not eligible

for a DASP

- Australian and New Zealand citizens or permanent residents of Australia are not eligible

- Benefits of a lost member (who is subsequently found) where their benefit in the fund at the time of release is less than $200. A member of a superannuation fund will be deemed lost where the fund has not received a contribution or a rollover within the last five years.

Insurance within superannuation

How does insurance through superannuation work?

There are generally three types of insurance available through superannuation:

- Life Insurance

- Total and Permanent Disablement (TPD) – any occupation definition

- Salary Continuance Insurance.

Key features of insurance through superannuation include:

- Premiums can be paid from your superannuation benefit

- The amount of premium is determined as per a normal insurance policy i.e. by taking into account a person’s age, gender, occupation and existing medical conditions

- The level of cover is selected by the member within limits determined by the insurer

- Cover will cease on the occurrence of a specific event, such as the member attaining a certain age or if they leave that specific fund. In some cases, however, the insurer will allow the member to take out an individual policy outside the superannuation environment.

Why attach insurance to superannuation?

Insurance through an employer superannuation fund is often arranged with group insurance rates, which can be less expensive than premium rates offered to individuals.

Employer superannuation funds often offer automatic acceptance levels of cover, reducing the need to provide medical information.

If a member is making salary sacrifice or personal deductible contributions to their super fund, they will be paying premiums with pre-tax rather than post-tax money.

Next Steps

To find out more, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. FinPeak Advisers does not provide personal tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark Financial Group ABN 15 621 553 786)

No Comments