20 Apr Tech Talk: The three stimulus packages summed up

- On Monday 23 March 2020, the Australian Federal Parliament passed two coronavirus economic stimulus packages, worth $17.6 billion and $66 billion.

- Subsequently on 30 March 2020 the Government announced the JobKeeker package, a new wage subsidy plan, and on 2 April 2020 a package to support early childhood education and care. The Treasurer announced on 5 April 2020 a reduced threshold for certain charities for JobKeeper eligibility.

- These measures were passed in a special sitting of Parliament on 8 April 2020. On 9 April 2020, a legislative instrument was registered containing rules for the JobKeeper payment.

- The stimulus packages include a range of important support measures for individuals and small businesses, we unpack them in a summary for you below.

1. Support for individuals and households

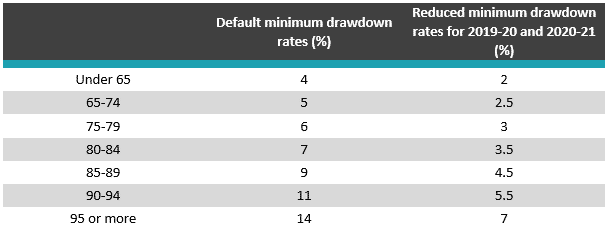

Temporarily reducing superannuation minimum drawdown rates

The Australian Government is temporarily reducing superannuation minimum drawdown requirements for account-based pensions and similar products by 50 per cent for 2019-20 and 2020-21. This measure will benefit retirees holding these products by reducing the need to sell investment assets to fund minimum drawdown requirements.

The reduction applies for the 2019-20 and 2020-21 income years.

Example: Mike is a 66 year old retiree with a superannuation account-based pension

The value of Mike’s account-based pension at 1 July 2019 was $200,000. Under current minimum drawdown requirements, Mike is required by legislation to drawdown 5 per cent of his account balance over the course of the 2019-20 and 2020-21 income years.

This means Mike has to drawdown $10,000 by 30 June 2020 to comply with the minimum drawdown requirements.

Following the temporary reduction in minimum drawdown requirements, Mike will now only be required to drawdown 2.5 per cent of his account balance, that is, $5,000, by 30 June 2020. If Mike has already withdrawn over $5,000 for 2019-20, he is not able to put the amount above $5,000 back into his superannuation account.

Australian Government Fact Sheet: Providing support for retirees

Temporary early release of superannuation

The Australian Government is allowing individuals affected by the coronavirus to access up to $10,000 of their superannuation in 2019-20 and a further $10,000 in 2020-21. Individuals will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments.

Eligibility

To apply for early release, you must satisfy any one or more of the following requirements:

- you are unemployed; or

- you are eligible to receive a JobSeeker payment, Youth Allowance for jobseekers, Parenting Payment (which includes the single and partnered payments), Special Benefit or Farm Household Allowance; or

- on or after 1 January 2020:

- you were made redundant; or

- your working hours were reduced by 20 per cent or more; or

- if you are a sole trader — your business was suspended or there was a reduction in your turnover of 20 per cent or more.

This condition of release is not available to market linked or transition to retirement income streams. However, those in transition to retirement income streams may partially commute to an accumulation account and use this condition of release to access benefits from the new accumulation account.

People accessing their superannuation will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments.

How to apply

If you are eligible for this new ground of early release, you can apply directly to the ATO through the myGov website: www.my.gov.au. You will need to certify that you meet the above eligibility criteria.

Australian Government Fact Sheet: Temporary Early Access to Superannuation

Social security deeming rates changes

As of 1 May 2020, the upper deeming rate will be 2.25 per cent and the lower deeming rate will be 0.25 per cent. The reductions reflect the low interest rate environment and its impact on the income from savings.

The change will benefit around 900,000 income support recipients, including around 565,000 people on the Age Pension who will, on average, receive around $105 more from the Age Pension in the first full year that the reduced rates apply.

Australian Government Fact Sheet: Providing support for retirees

Coronavirus supplement

Over the next six months, the Australian Government is temporarily expanding eligibility to income support payments and establishing a new, time-limited coronavirus supplement to be paid at a rate of $550 per fortnight. This will be paid to both existing and new recipients of JobSeeker Payment, Youth Allowance Jobseeker, Parenting Payment, Farm Household Allowance and Special Benefit.

The coronavirus supplement and expanded access for payments will commence from 27 April 2020.

Australian Government Fact Sheet: Income support for individuals

Up to two support payments of $750

On 12 March 2020, the Australian Government announced a one-off $750 stimulus payment to pensioners, social security, veteran and other income support recipients and eligible concession card holders. Around half of those that will benefit are pensioners.

The payment will be tax free and will not count as income for Social Security, Farm Household Allowance and Veteran payments. It will be paid automatically from 31 March 2020.

The Australian Government also is providing a second payment of $750 that will be made from 13 July 2020. This payment will be made to those residing in Australia and receiving one of the payments or holding one of the concession cards that were eligible for the first payment, except for those who are eligible to receive the coronavirus supplement (that is, those eligible for JobSeeker Payment, Youth Allowance Jobseeker, Parenting Payment, Farm Household Allowance and Special Benefit).

Australian Government Fact Sheet: Payments to support households

Early childhood education and care relief package

On 5 April 2020, the Government registered legislation that temporarily changes the funding arrangements for the early childhood education sector. The Government will pay 50 per cent of a child care service’s fee revenue (or 50 per cent of the existing hourly rate cap if that is lower) calculated based on the number of children in care during the fortnight preceding 2 March 2020 (before parents began withdrawing children in large numbers). The funding is subject to a number of conditions, including that services must remain open (or closed because a health agency has advised or required the service to be closed due to the coronavirus) and that families are not charged a fee, including an out of pocket or gap fee. The funding will apply from 6 April 2020 until 28 June 2020.

The plan supports families while also ensuring as many of the sector’s 13,000 child care and early learning services as possible can keep their doors open for workers and vulnerable families who need those services. Around one million families are set to receive free child care.

2. Business stimulus

JobKeeper Payment

The JobKeeper Payment will help businesses affected by the coronavirus cover the costs of their employees’ wages, help more people to retain their jobs and continue to earn an income. The scheme involves the Australian Government paying employers a wage subsidy at a flat rate of $1,500 per employee per fortnight for up to six months. The JobKeeper Payment will be backdated to 30 March 2020 for employers who register in April 2020. Employers who register after April 2020 will receive JobKeeper Payment on a prospective basis.

There is no cap on the number of employees eligible for the subsidy. This amount is equivalent to around 70% of the Australian median wage and in the accommodation, hospitality and retail industries, it is equivalent to the full median wage.

Eligible employers

Employers with turnover of less than $1 billion are eligible if they experience at least a 30% decline in revenue since 1 March in a month versus the prior year. Businesses with annual turnover of $1 billion or more are eligible if their turnover falls by more than 50%.

Employers must apply to the Australian Taxation Office (ATO) to participate in the scheme and provide supporting information demonstrating the impact felt in their business. Employers will also need to continue to report to the ATO the number of eligible employees employed by their business each month.

Self-employed individuals (businesses without employees) that meet the turnover tests that apply for employers are eligible to register one person, who is actively engaged in operating the business, for JobKeeper Payments. Eligible individuals include a sole trader, partner in a partnership, beneficiary of a trust and a director or shareholder of a company.

On 5 April 2020 the Treasurer, The Honourable Josh Frydenberg, announced that charities that are registered with the Australian Charities and Not-for-Profits Commission will be eligible for the JobKeeper Payment if they have suffered a 15 per cent decline in turnover as a result of the coronavirus. This measure is to support a sector which is expected to have a significant increase in demand for its services.

Eligible employees

Employers will receive the payment for each eligible employee (employed at 1 March 2020) who continue to be employed. This includes full-time and part-time employees, casuals with regular service in the 12 months prior to 1 March 2020, and stood down employees. Employees who have been stood down since 1 March can also be re-engaged and receive the wage subsidy. Self-employed business owners will be eligible to receive the JobKeeper Payment where they have suffered or expect to suffer a 30 per cent decline in turnover relative to a comparable prior period (of at least a month).

To be an eligible employee, the individual will need to be at least 16 years old on 1 March 2020 and satisfy an Australian residency requirement.

Individuals receiving parental leave pay or paid dad and partner pay will not be eligible for a JobKeeper Payment for any fortnight they are entitled to these payments.

Payments will be made to employers by the ATO after the end of the calendar month, with the first payments to be received in the first week of May.

Register via the ATO website: https://www.ato.gov.au/Job-keeper-payment/

Australian Government Fact Sheet: JobKeeper Payment – Information for Employers

JobKeeper Payment – Information for Employees

Boosting cash flow for employers

The Australian Government is providing up to $100,000 to eligible small and medium-sized businesses, and not for-profits (NFPs) that employ people, with a minimum payment of $20,000. These payments will help businesses and NFPs with their cash flow so they can keep operating, pay their rent, electricity and other bills and retain staff.

Small and medium-sized business entities with aggregated annual turnover under $50 million and that employ workers are eligible. NFPs, including charities, with aggregated annual turnover under $50 million and that employ workers will now also be eligible. This will support employment at a time where NFPs are facing increasing demand for services.

Under the enhanced scheme, employers will receive a payment equal to 100 per cent of their salary and wages withheld (up from 50 per cent), with the maximum payment being increased from $25,000 to $50,000. In addition, the minimum payment is being increased from $2,000 to $10,000.

The payment will be delivered by the ATO as an automatic credit in the activity statement system from 28 April 2020 upon employers lodging eligible upcoming activity statements.

An additional payment is also being introduced in the July – October 2020 period. Eligible entities will receive an additional payment equal to the total of all of the Boosting Cash Flow for Employers payments they have received. This means that eligible entities will receive at least $20,000 up to a total of $100,000 under both payments.

Australian Government Fact Sheet: Cash flow assistance for businesses

Temporary relief for financially distressed businesses

It’s vital that businesses have a safety net to ensure that when the crisis has passed, they can resume normal business operations. The Australian Government is temporarily increasing the threshold at which creditors can issue a statutory demand on a company and the time companies have to respond to statutory demands they receive.

The package also includes temporary relief for directors from any personal liability for trading while insolvent, and providing temporary flexibility in the Corporations Act 2001 to provide temporary and targeted relief from provisions of the Act to deal with unforeseen events that arise as a result of the coronavirus health crisis.

The ATO will tailor solutions for owners or directors of business that are currently struggling due to the coronavirus, including temporary reduction of payments or deferrals, or withholding enforcement actions including Director Penalty Notices and wind-ups.

Australian Government Fact Sheet: Temporary relief for financially distressed businesses

Increasing the instant asset write-off

The Australian Government is increasing the instant asset write-off threshold from $30,000 to $150,000 and expanding access to include businesses with aggregated annual turnover of less than $500 million (up from $50 million) until 30 June 2020.

In 2017-18 there were more than 360,000 businesses that benefited from the current instant asset write-off, claiming deductions to the value of over $4 billion.

Australian Government Fact Sheet: Delivering support for business investment

Backing business investment

The Australian Government is introducing a time limited 15-month investment incentive (through to 30 June 2021) to support business investment and economic growth over the short term, by accelerating depreciation deductions.

Businesses with a turnover of less than $500 million will be able to deduct 50 per cent of the cost of an eligible asset on installation, with existing depreciation rules applying to the balance of the asset’s cost.

Australian Government Fact Sheet: Delivering support for business investment

Supporting apprentices and trainees

The Australian Government is supporting small business to retain their apprentices and trainees. Eligible employers can apply for a wage subsidy of 50 per cent of the apprentice’s or trainee’s wage for 9 months from 1 January 2020 to 30 September 2020.

Where a small business is not able to retain an apprentice, the subsidy will be available to a new employer that employs that apprentice. Employers will be reimbursed up to a maximum of $21,000 per eligible apprentice or trainee ($7,000 per quarter).

Support will also be provided to the National Apprentice Employment Network, the peak national body representing Group Training Organisations, to co-ordinate the re-employment of displaced apprentices and trainees throughout their network of host employers across Australia.

Australian Government Fact Sheet: Cash flow assistance for businesses

Support for coronavirus-affected regions and communities

The Australian Government will set aside $1 billion to support regions most significantly affected by the coronavirus outbreak. These funds will be available to assist during the outbreak and the recovery. In addition, the Australian Government is assisting our airline industry by providing relief from a number of taxes and Australian Government charges estimated to total up to $715 million.

Australian Government Fact Sheet: Assistance for severely affected regions and sectors

Coronavirus Business Liaison Unit

A Coronavirus Business Liaison Unit has been established within The Treasury to engage with business on a regular basis and provide updates to government on crucial issues.

3. ASIC relief to support financial advice on stimulus and other measures

On 14 April 2020, ASIC announced temporary relief measures that will assist the financial services industry in providing consumers with affordable and timely advice during the pandemic. These measures are covered by a legislative instrument registered on 14 April 2020. Important conditions apply to the relief, these are covered in detail in the legislative instrument and explanatory statement and summarised in ASIC’s 14 April 2020 media release, and FAQs.

Subject to meeting the important conditions, the instrument provides temporary relief to:

- allow financial advisers not to give a Statement of Advice (SOA) to a client when providing advice about the early release scheme, subject to several conditions, including:

- clients must be provided with a record of advice (ROA), which meets certain content requirements;

- the advice fee, if any, is capped at $300;

- the advice provider must establish that the client is entitled to the early release of their superannuation; and

- the client must have approached the advice provider for the advice;

- permit registered tax agents to give advice about the early release of superannuation to their existing clients without needing to hold an Australian financial services (AFS) licence, subject to several conditions;

- give advice providers up to 30 business days (instead of 5 business days) to give a SOA after time-critical COVID-19 advice is provided; and

- enable a Record of Advice (ROA) to be given instead of an SOA for COVID-19 advice, in certain defined circumstances to existing clients of financial advisers.

Noting the relief is temporary, ASIC has committed to consulting with industry stakeholders and giving 30 days’ notice before implementing any decision to repeal the relief measures.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or [email protected].

This article was originally produced by Macquarie (click here to view the full article).

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments