16 Oct Market Commentary – October 2018

Global Market Outlook: Holding steady for now

Reasonable valuations and good earnings outlook should assist global equities in the face of higher rates. While technology remains dominant in global markets, Japanese equities enjoyed a standout performance in September. Australian equities eased back during the month, even though forward earnings ticked a little higher – as a lift in bond yields helped push down the “pricey” PE ratio.

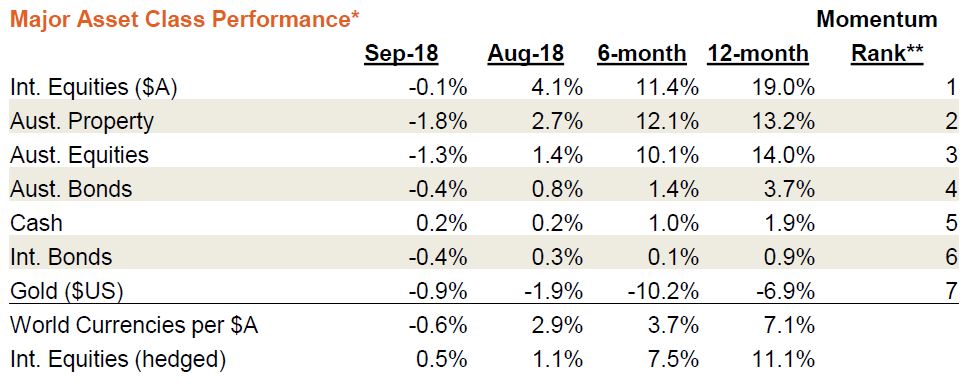

US interest rate concerns together with lingering global trade tensions caused both bond and equity returns to stumble in September, which in turn allowed cash to emerge as the best performing

asset class! US wage inflation jitters and the Fed’s avowed determination to keep lifting rates saw US 10-year bond yields rise 0.2pp from 2.86% to 3.06%.

That said, International Equities did manage to return 0.5% in the month in local currency terms, though a modest rebound in the $A caused their returns to decline in unhedged $A terms. In terms of relative momentum, International Equities and Australian property remained the two strongest performing asset classes at end-September, while gold and international bonds were the weakest.

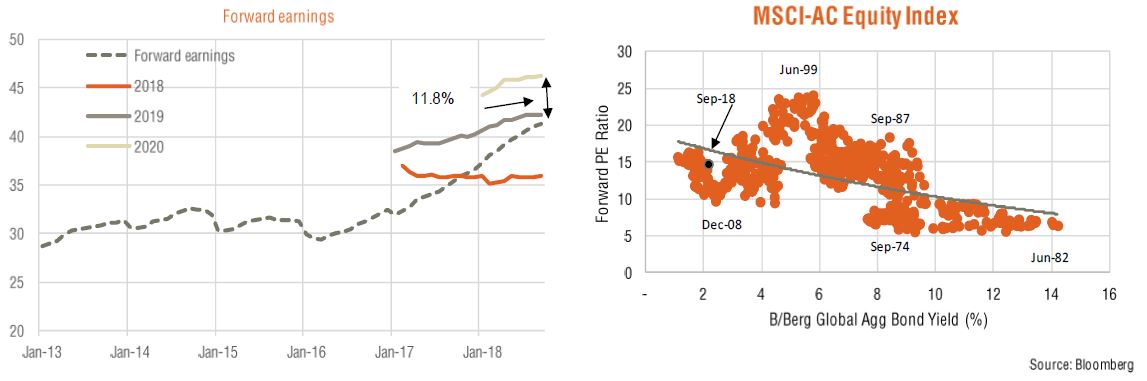

The notable challenge to global equities in September was the leap higher in global interest rates. That said, forward earnings continued to rise such that the market’s overall PE ratio remained

unchanged at a reasonable 14.8 Relative to interest rates, PE valuations also do not appear excessive, and the earnings outlook remains upbeat. This provides some scope for global equities to withstand a further possible modest lift in global rates.

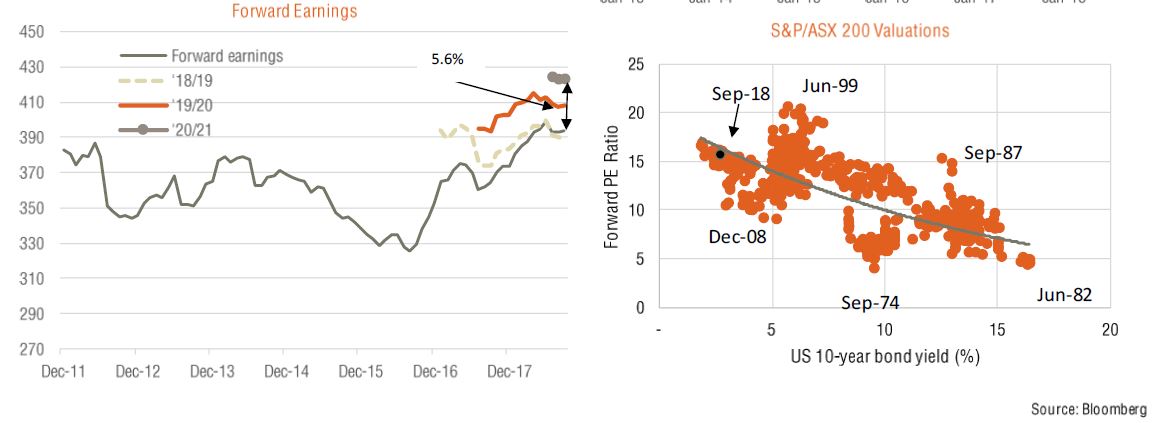

Australian equities eased back in September, even though forward earnings ticked a little higher – as a lift in bond yields helped push down the “pricey” PE ratio from 16.1 to 15.8. As noted last month, relative to current bond yields, local equities could be considered “fair-value”, but have become somewhat expensive relative to global equities. Another challenge is that earnings expectations appear to be edging lower and anticipated forward earnings growth of 5.5% by end-2019 is only half that expected from global equities. The recent earnings reporting season has not led to significant upgrades overall.

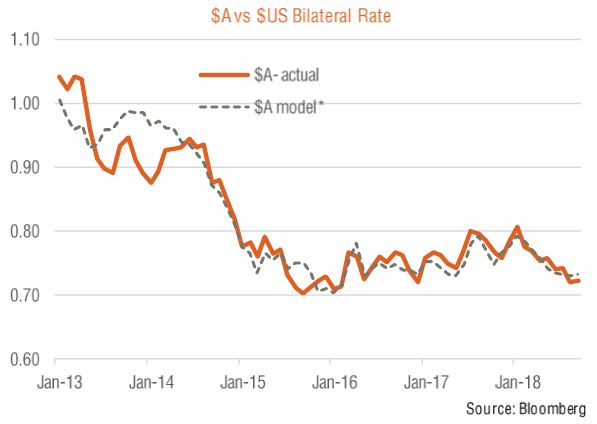

After several months of losses, the $A firmed a little against the $US in September, helped by firmer iron-ore prices and a broadly steady $US. Modelling suggests the $A is currently around fair value given these fundamentals. Although hopes of Chinese policy stimulus could result in stronger iron-prices over the near term, ongoing Chinese steel onsolidation suggests eventual further weakness ahead. Along with a stronger $US and a continued narrowing in interest rate differentials, this suggests the $A should remain under downward pressure.

For the full article, you can read it here.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments