24 Mar Market Commentary – March 2020

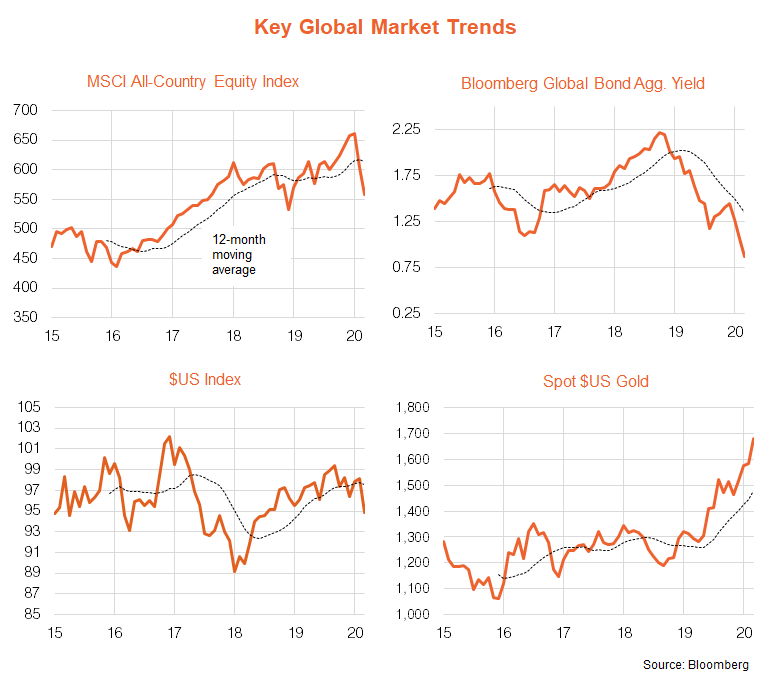

Key Global Trends – equities retreat

The coronavirus-led ‘risk-off’ trade that started to build in late January continued into February and the early weeks of March. Global equities have reversed their uptrend seen through most of 2019, while the downtrend in bond yields and uptrend in gold prices has continued. The $US is also showing signs of weakness so far in March, with expectations of significant US monetary stimulus to offset potential weakness in the US economy arising from the global virus outbreak.

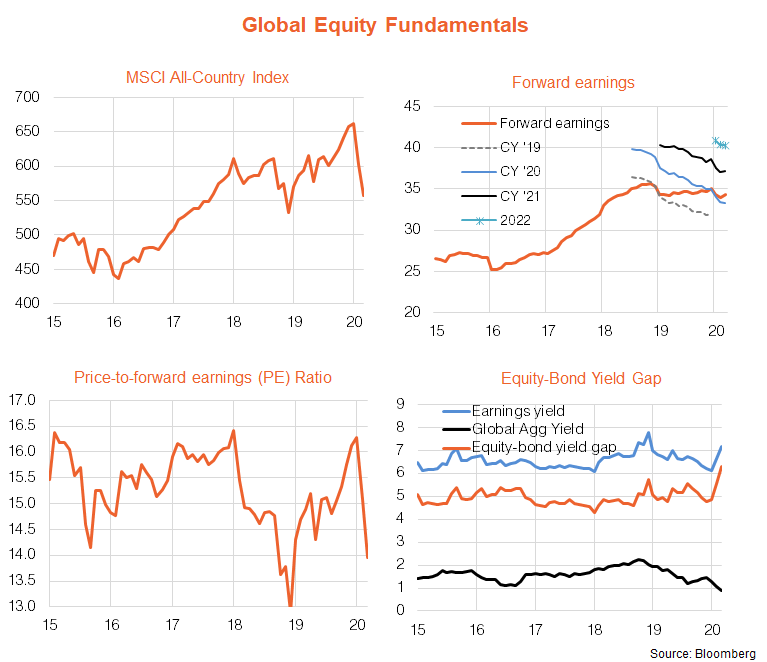

Global Equity Fundamentals

As seen in the chart pack below, the decline in global equities has pushed the price-to-earnings ratio from a high of 16.3 in January to near-average 14.0 by early March. Given the further large decline in bond yields, the equity-to-bond yield gap (EBYG) (a measure of relative valuations) has pushed out to an above-average level of 6.3%. As noted last month, however, of concern is the continued downtrend in earnings expectations, which suggest forward earnings will at best remain flat for several more months or even decline somewhat if global growth slows further.

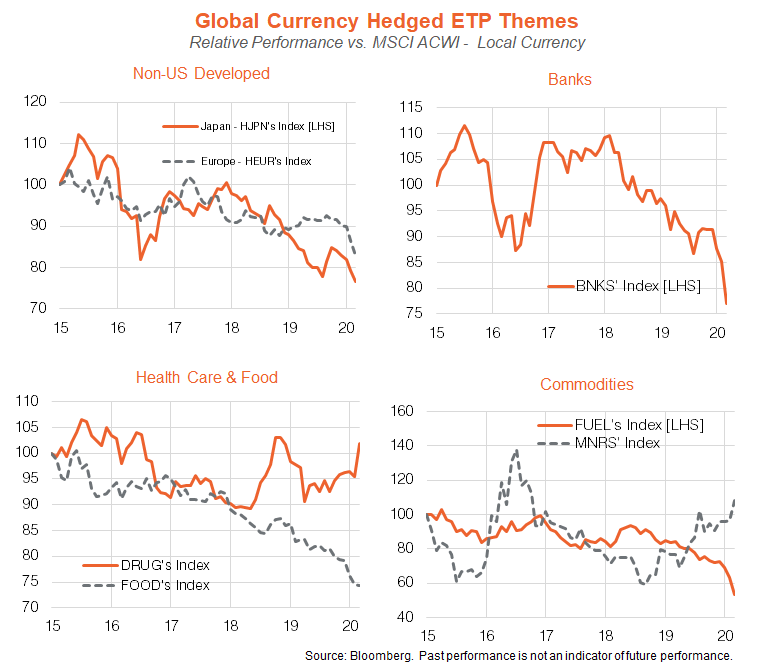

Global Equity Trends

Across market sectors, global gold miners and health care have been the best performers in recent months and remain the strongest relative performers. Financial and energy stocks continue to be hurt by declining bond yields and oil prices respectively, while Europe, Japan and the food sector also continue to underperform. The emerging-market sector has held up relatively well since January, which is consistent with broader EM outperformance over this period – possibly in turn associated with a weakening in the $US.

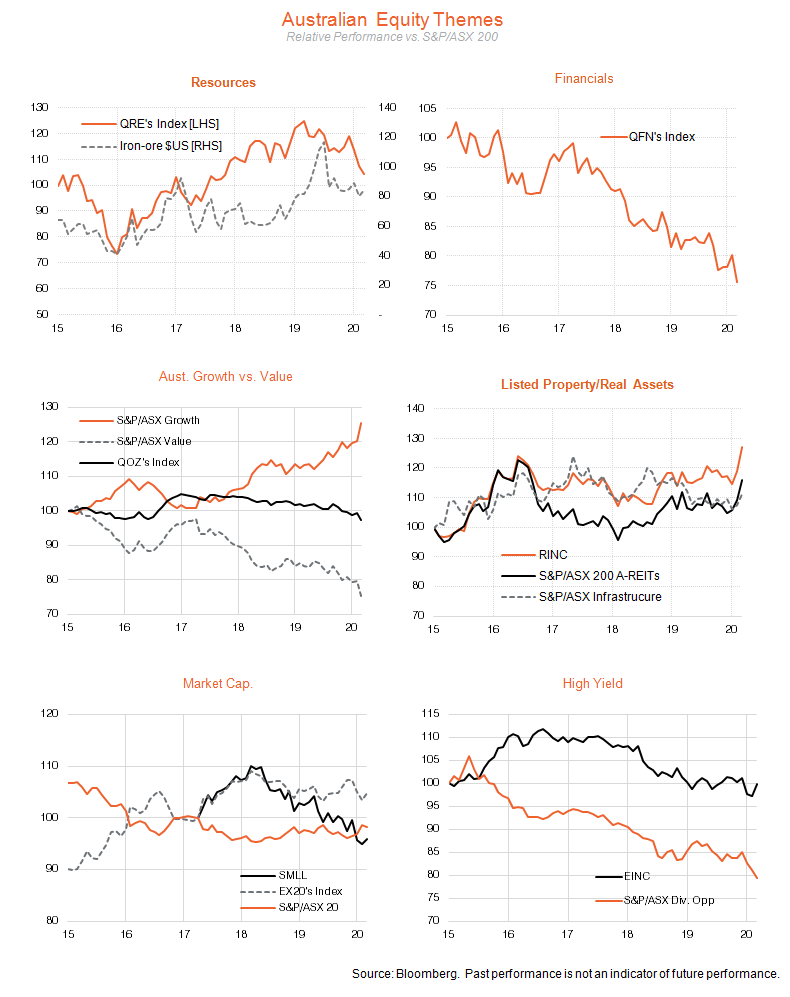

Australian Equity Trends

The major financial and resource sectors of the Australian market continue their period of trend underperformance, with the former also hurting performance of the high-yield segment of the market. That said, the growth segment of the market continues to outperform, helped by exposure to the dominant health care stock, CSL. Indeed, health care, consumer staples and telecommunications have the strongest trend relative performance.

The recent market sell-off has also seen relative outperformance by the infrastructure and listed property sector, as investors seek defensive yield opportunities outside of the beleaguered banking sector.

Outlook for investment markets

Shares are likely to see further short-term falls given the uncertainty around the coronavirus, both in terms of the outbreak’s duration and its economic impact. On a 12-month horizon though, shares are expected to see good total returns, helped by an eventual rebound in economic activity and policy stimulus.

Low starting-point yields are likely to result in low returns from bonds once the dust settles from the coronavirus.

Unlisted commercial property and infrastructure are likely to continue benefitting from the search for yield, but the decline in retail property values and the hit to economic activity from the virus will weigh on near-term returns.

Our base case is that capital city house prices will continue to rise, but at a slower pace than has been the case. This, however, is now under threat given the expected recession in response to coronavirus disruption. A sharp rise in unemployment would pose a major threat to the property market. Hopefully, stimulus measures will head that off (as occurred in the GFC) and bank deferrals of debt repayments will also help.

Cash & bank deposits are likely to provide very poor returns, with the RBA cutting the cash rate to 0.25%.

The deepening hit to global growth from Covid-19 and its flow on to reduced demand for Australian exports and lower commodity prices now risks pushing the Australian dollar to a re-test of its 2001 low of US$0.477. Expect a strong rebound once the threat from coronavirus recedes though.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

This article was originally produced by Beta Shares (click here to view the full article and) and AMP (click here to view).

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments