28 Feb Market Commentary – Feb 2019

Major Asset Classes – global equities storm back

Global equities returned a strong 7.3% in local currency terms during January, unwinding their 7.2% slump in December. The return in $A terms, however, was a more muted 4.5% reflecting a rebound in the Australian dollar over the month.

Several factors supported the equity rebound, though the most important was likely an easing in US interest rate fears as the Federal Reserve turned more “dovish”. Indeed, after having raised rates four times in 2018, the Fed now says it can be more “patient” in raising rates further, and the market has largely priced out the risk of further policy tightening this year. Other supportive factors were ongoing good economic growth indicators in the US economy, a solid start to the Q4 US earnings reporting season and encouraging signs that the US and China will conclude some form of a trade deal in coming months.

Easing Fed fears saw bond yields drop further, which supported fixed-income bond returns, while an associated weakening in the $US also helped gold prices – despite the rebound in risk sentiment. Listed property also continued to benefit from the decline in bond yields.

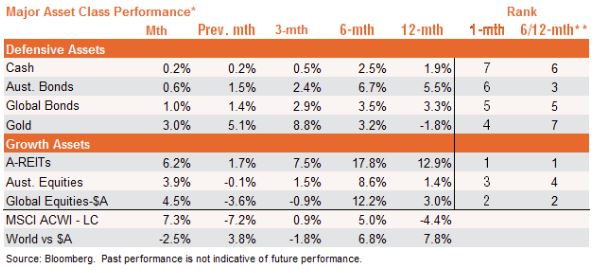

Across the seven benchmark asset classes, Australian listed property (A-REITs) produced the best performance in December, returning 6.2%. Cash produced the lowest return of only 0.2%. By 6-12 month return momentum rank, listed property was the best performing asset class, followed by international equities – while gold remains the worst performer.

As evident in the summary chart below, global equities are still below their peak levels of earlier last year, while the easing in bonds yields has supported relative performance of listed property versus Australian equities more broadly. Compared to global equities, relative Australian equity performance has been choppy but still retains a modest under performing bias. Gold prices have also been choppy, with weak performance earlier last year but a solid rebound since late September.

Market Outlook

The Fed’s dovish tilt and signs of progress in US-China trade talks have been positive market developments of late, suggesting some of the risk factors that weighed on global equities in recent months could be dissipating. Also heartening is the fact that recent US inflation reports have remained fairly benign, helped by still reasonably low wage growth. At current interest rates levels, moreover, global equities valuations still don’t appear overly demanding.

That said, the key risk remains a faster acceleration in US wage inflation given the apparent tightness of the US labour market. If wage inflation takes off, the Fed would have little choice but to continue raising rates – potentially to recession inducing restrictive levels later this year. Also concerning is the fact that US earnings expectations for the 2019 have been downgraded somewhat in recent months, and overall earnings growth this year is now expected to be quite muted. This suggests a growing level of caution may be required this year with regard to equities, with an increasing focus on more defensive areas of the market.

This article was produced by David Bassanese from BetaShares, you can read the full article here.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments