21 Dec Market Commentary – December 2018

Overview – global equities stage a modest comeback

Global equities returned a modest 1.3% in local currency terms during November, partly unwinding their sharp 6.9% slump in October. An easing back in global bond yields supported both bond and equity returns in the month, reflecting persistent low US inflation reports and signals from the US Federal Reserve that it may be getting closer to a pause in its rate hike campaign. Also supporting equities were growing hopes around US-China trade talks at the G-20 meeting.

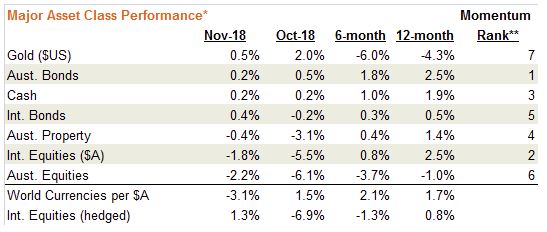

Across the seven benchmark asset classes, gold produced the best performance in November, albeit with a modest 0.5% gain. Although global equities rose by 1.3% in local currency terms, a rebound in the $A hurt performance in unhedged $A terms. Australian equities produced the worst asset class return of negative 2.2%, not helped by weaker iron-ore prices and a stronger $A dragging down local resource stocks. By momentum rank, Australian bonds are the best performing asset class, followed by international equities – while gold remains the worst performer.

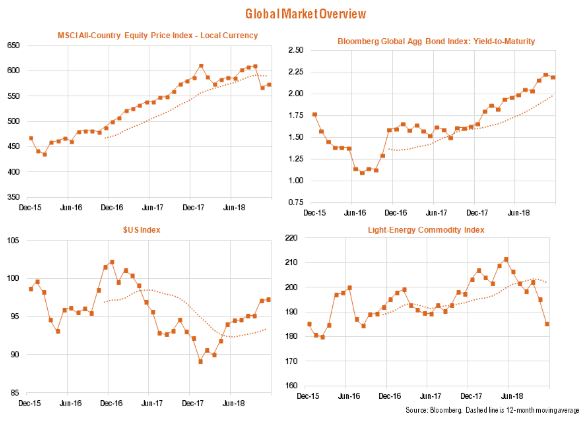

As evident in the summary chart below, global equities are still yet to reclaim their month-end highs of earlier this year, while global interest rates and the $US are still trending up. Led by weaker oil prices, commodities overall continue to trend down.

Market Outlook

The Fed’s dovish tilt and signs of progress in US-China trade talks have been positive market developments of late, suggesting some of the risk factors that weighed on global equities in recent months could be dissipating. Also heartening is the fact that recent US inflation reports have remained fairly benign, helped by still reasonably low wage growth and falling energy prices. At current interest rates levels, moreover, global equities valuations still don’t appear overly demanding, while earnings are still expected to post slower, but still decent, growth over the coming year.

That said, the key risk remains a faster acceleration in US wage inflation given the apparent tightness of the US labour market. If wage inflation takes off, the Fed would have little choice but to continue raising rates – potentially to recession inducing restrictive levels next year. At this stage, however, this remains only a risk – rather than my base case.

*Asset Benchmarks Cash: UBS Bank Bill Index; Australian Equities: S&P/ASX 200 Index; Australia Bonds: Bloomberg Composite Bond Index; Australian Property: S&P/ASX 200 A-REITs; International Equities: MSCI All-Country World Index, unhedged $A terms; Commodities: S&P GSCI Light Energy Index, $US terms.

** Momentum rank based on equally-weighted average of 6 & 12 month return performance.

This article was produced by David Bassanese from BetaShares, the full extract can be found here.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments