20 Apr Market Commentary: April 2020

Key Global Trends – equities slump

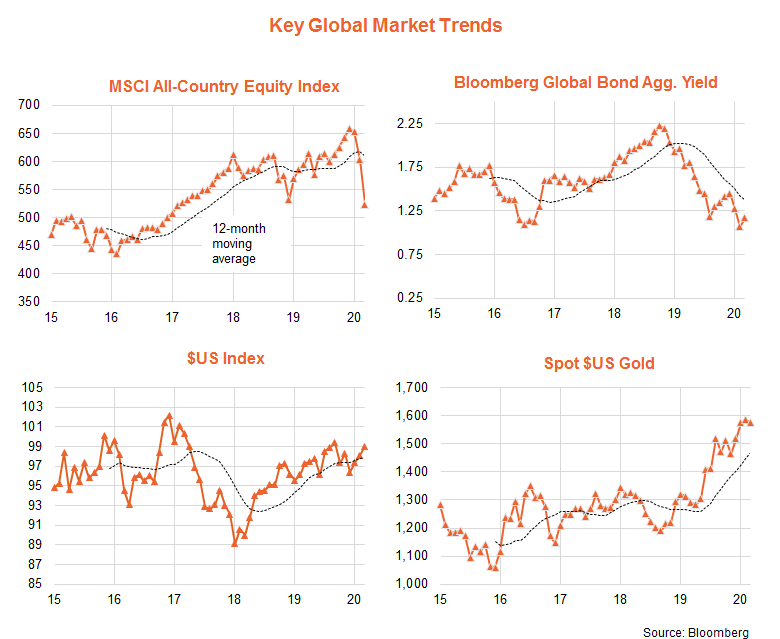

The coronavirus-led ‘risk-off’ trade that started to build in late January continued into March, with the MSCI All-Country World Equity return index declining by 12.8% in local currency terms. Despite declining government bond yields, the yield on the Bloomberg Global Aggregate Bond Index actually edged up from 1.07% to 1.17% in the month – due to a major widening in credit spreads – resulting in this benchmark global bond index producing a negative 1.5% return. A global dash for cash caused the U.S. dollar to firm, while gold prices edged lower.

As seen in the chart set below, global equities and bond yields remain in a downtrend*, while both gold and the US$ remain in an uptrend.

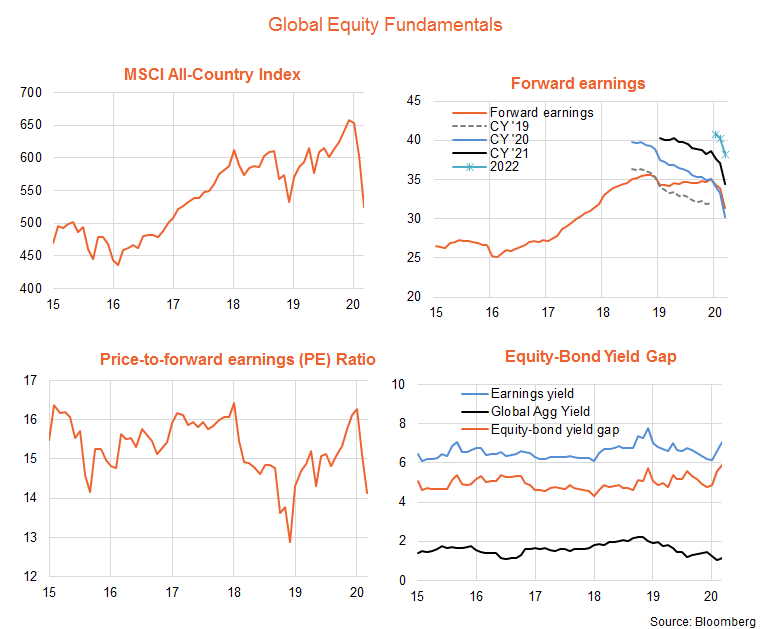

Global Equity Fundamentals – watch earnings

As seen in the chart pack below, the decline in global equities has pushed the price-to-forward earnings ratio from a high of 16.3 in January to near-average 14.1 by end March. The most notable development in the past month, however, has been the (understandable) slump in earnings expectations. Forward earnings have already declined by 10.6% since the start of the year. CY’20 earnings are now expected to fall 5.3% below CY’19 levels before rebounding by 14% in CY’21. However, these expectations are likely to drop substantially further in the weeks and months ahead (CY’20 earnings are predicted to fall by at least 20%) as the impact of global shutdowns on corporate earnings become evident.

Given the small increase in overall bond yields, the equity-to-bond yield gap (EBYG) (a measure of relative valuations) has pushed out to an above-average level of 5.9%. As noted last month, however, of concern is the likely continued downtrend in earnings expectations, which will tend to push up PE valuations unless equity prices also adjust downward to some degree.

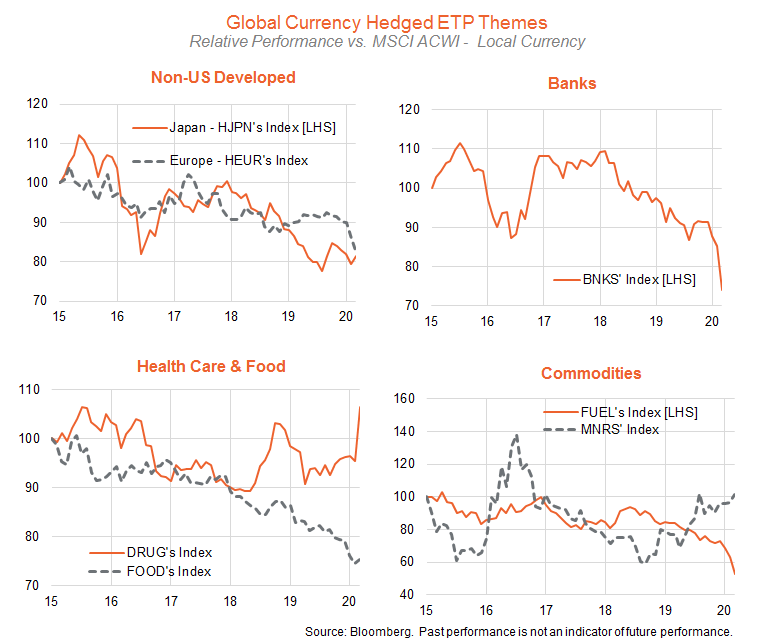

Global Equity Trends – health care, gold, technology & Asia

Across equity sectors, health care and global gold miners were the best performers in the month (though both still produced negative returns) and remain the strongest relative performers**. Financial and energy stocks are the worst performers, with each especially hurt by declining interest rates and oil prices respectively.

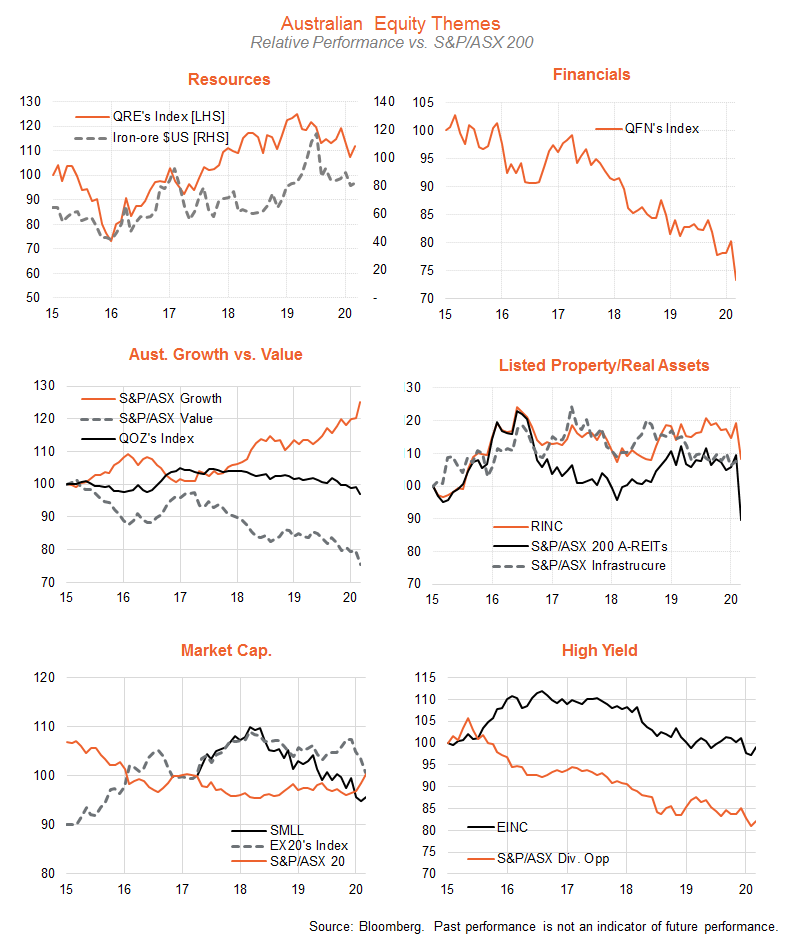

Australian Equity Trends – health care and consumer staples

Defensive sectors such as health care, consumer staples and telecommunications held up best last month, though all still suffered negative returns. Resources slightly outperformed, though along with financials remain in relative performance downtrends. By factor, growth also continued to outperform value (the latter weighted down by banks), even though large cap stocks overall are holding up better than smaller/mid-cap stocks – as is to be expected in a “risk-off” environment. Even infrastructure and listed property have not been spared in last month’s sell-off, with the latter especially hurt by pressure on rents due to the shutdown of many businesses.

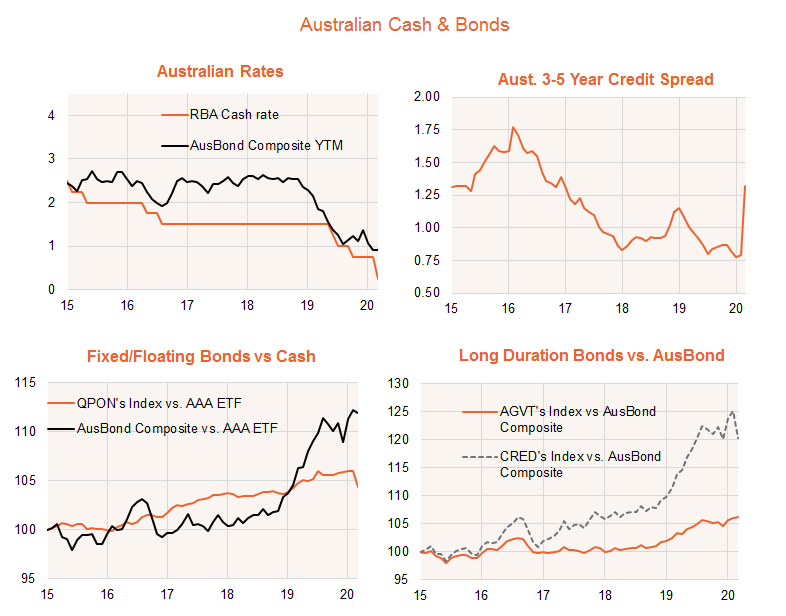

Cash & Bonds – government yields drop, credit spreads widen

As would be expected, government bond yields declined further in the month, helped by further RBA rate cuts and the central bank’s decision to explicitly target a 0.25% yield for 3-year government bonds. Credit spreads widened, however, reflecting concerns over the economy but also an element of market dislocation (caused by worldwide liquidation of both good and bad assets to build cash), which central banks are endeavouring to overcome through liquidity injections.

The net result was that the yield on the Bloomberg AusBond Composite Index (covering fixed-rate bonds issued by both governments and private corporations) edged only slightly lower in the month, from 0.92% to 0.90%. Wider spreads saw senior bank floating rate bonds and long-duration corporate bonds underperform the AusBond Composite respectively, while long-duration government bonds outperformed the AusBond Composite.

Wider spreads also produced a negative return within the hybrids market during March, declined by 6.3% – which, nonetheless, again demonstrated hybrids have generally tended to fall less than equities in extreme risk-off environments.

Source: Bloomberg. Past performance is not indicative of future performance.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or [email protected].

This article was originally produced by Beta Shares (click here to view the full article).

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments