25 Sep Business Exit Planning

Every business owner will one day exit their business. Sometimes it will be due to an insurable event, such as death. But there are a broad range of exit triggers that are not insurable, some of which can be planned (such as a trade sale or retirement) and others that are not planned (such as where there is a fall-out or dispute between owners).

To minimise disruptions and ensure an orderly transfer of ownership, principals should consider establishing a:

- Business Owners’ Agreement that deals with both planned and unplanned events that can’t be funded by insurance, as well as a range of matters concerning the rights and conduct of the owners in relation to each other, and

- a (ideally) separate Buy Sell Agreement where the exit of an owner due to death, Total and Permanent Disability (TPD) and, in some cases, Critical Illness (CI) is funded or part-funded by ownership protection insurance. This topic will be discussed in further detail in a later post.

Business Owners’ Agreements

Each of the relevant triggers should be addressed and plans put in place in what is called a Business Owners’ Agreement. The benefits of doing this include:

- protecting the value of the business

- helping the business owners to extract maximum value when exiting the business, and

- for some type of exits, avoiding costly legal bills, which can be a very common occurrence.

The type of Agreement will depend on the structure used to carry on the business.

Key examples include a:

- Partnership Agreement for a partnership

- Shareholders’ Agreement for a company, and

- Unitholders’ Agreement for a unit trust.

These Agreements are customised and completing them can be a lengthy process when compared to Buy Sell or Debt Reduction Agreements, which are relatively straightforward. This is because:

- the dynamics, characteristics and issues of different businesses vary (eg where there are minority owners, it is a family business or there are key person dependencies)

- the value or goodwill in a business can arise from different sources, such as intellectual property, client servicing rights or an exclusive right to import, and

- some businesses may require owners to contemplate disputes, owners resigning and setting up in competition and a range of other issues.

Sometimes where two or three owners have been working productively together in a business for years, a Business Owners Agreement may be unnecessary. However, a Buy-Sell Agreement is almost always necessary, as it facilitates a smooth and equitable transfer of business ownership when an owner departs the business due to death, total and permanent disability or trauma.

Issues dealt with in Agreements

Here is a list of issues that Business Owners’ Agreements commonly deal with, using the example of a Shareholders’ Agreement between the owners of a company.

Business Valuation – can be an agreed dollar amount, based on a formula (eg multiple of EBIT) or as determined by an accredited and independent valuer.

Right of First Refusal – the remaining shareholders may want the first right to acquire the departing shareholder’s shares. The right of first refusal can be important in the event that an owner gets divorced or becomes bankrupt. It can force the departing owner to transfer their equity to the remaining owners so that the equity doesn’t end up in the hands of the spouse or trustee in bankruptcy respectively.

Retirement – Some Agreements allow for the retirement of an owner within a given notification period (eg 12 months) and include a schedule for the other owners funding the exit, along with an agreed business valuation.

Resignation – Clauses covering the resignation of an owner may stipulate a notification period, but the value the outgoing owner receives may be at a discount to the agreed business valuation (for example, 50% to 75%), particularly if the resignation is without a trade restraint.

Trade Restraint – these clauses are used to protect the value of the business and may include restrictions such as preventing the outgoing owner from soliciting clients and/or setting up a competing business but they need to be reasonable as they could otherwise be unenforceable.

Dispute Resolution – A ‘Russian Roulette’ or ‘Shotgun’ clause is an example of a mechanism that can break a deadlock or impasse. This clause becomes operative when one of the owners (‘first’) makes an offer to buy the other (‘second’) owner’s shares for a certain amount (eg $500,000). Having received the offer, the second owner has to choose within a short timeframe to either:

- accept the offer and sell their shares to the first owner, or

- buy the first owner’s shares for $500,000.

Minority Shareholder Clauses – Issuing shares to key employees can help a business hold on to their valuable staff. However, in doing so, the owners do not want to have minority shareholders blocking key decisions.

Dividend Policy, Remuneration and Capital Contributions – An agreed dividend policy can prevent disputes arising where some shareholders want to receive a certain level of income via a dividend, but others want to re-invest profits in the business.

Agreed remuneration could be important where there is a silent partner, or more generally, where some play a more active role than others in the business.

Performance – Some Agreements may contain a clause that stipulates a minimum level of performance of the owner’s duties to ensure they are ‘pulling their weight’.

Participation – Participation in a business can be related to performance but can also deal with related issues, such as non-participation due to illness and injury.

The business can take out Income Protection policies to help fund payment of a salary to an owner who is unable to participate in the business due to illness or injury.

Death, Terminal Illness, Mental Incapacity and TPD – Where one of the above events occurs, the remaining owners can be left with a ‘silent partner’, being the affected owner who is unable to work in the business, or the affected owner’s beneficiaries or legal personal representative (for example, the executor of their estate).

At best, the remaining owners’ new ‘silent partner’ will remain silent, participating in the business’ capital growth and distributions with no input. From their perspective, they may remain exposed to the business if their personal assets secure business debt.

At worst, the ‘silent partner’ may not remain silent and interfere or disrupt the business, particularly if there’s a disagreement between the parties with regards matters such as how much the business is worth and what the dividend policy should be.

Given such scenarios can be avoided by agreeing to a business valuation before anything happens to anyone and insuring these exits, these are relatively simple exits that all parties should be able to agree on if they understand the exposure. For this reason, the general practice is to put these clauses in a separate agreement known as a Buy-Sell Agreement which can be put in place quickly.

Where these exits are not insured or part insured, vendor’s finance can be an alternative way of funding or part-funding them.

Trauma – Trauma of an owner can also be funded with insurance. However, while an owner who has suffered a trauma may be unable or unwilling to return to the business, there is also the significant likelihood of that affected owner being willing and able to return to work.

The Agreement can deal with this by allowing an affected owner a period of time (generally between three and nine months) within which they may recover and return to work.

The Agreement also needs to consider that if the affected owner does return to work and they retain their shareholding, they have been paid an insurance benefit that was supposed to have been in consideration for the transfer of their shares to the other owners.

There are various approaches to this scenario from treating the insurance payout as a windfall for the affected owner, to requiring the proceeds be loaned back to the business or placing the proceeds in trust.

With the latter approach, the amount in trust could either be paid out in the event the affected owner left due to health reasons at a later time or (that not being the case) eventually divided up amongst all the owners at another point.

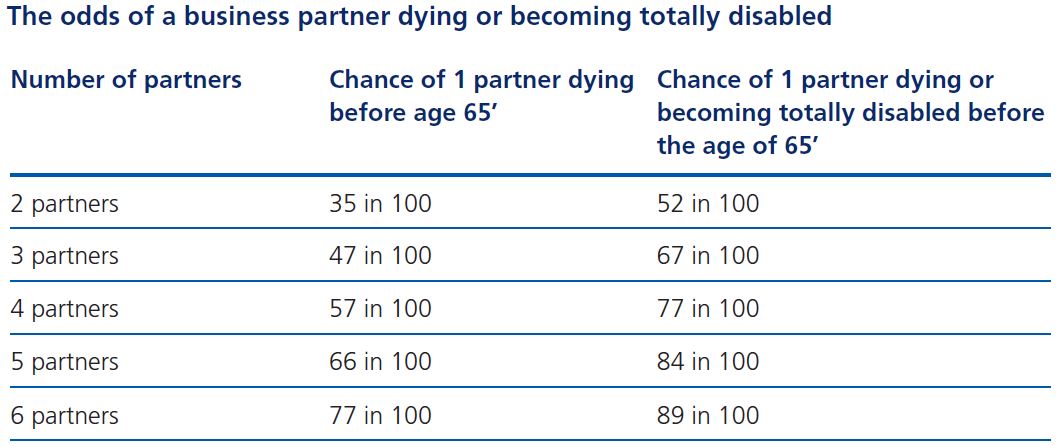

Source: Zurich Life whitepaper “What are the odds?” 15 July 2016

How we can help?

While many owners start out in business on friendly terms and respecting each other, a Business Owners’ Agreement can protect them from any unforeseen circumstances. Some of these circumstances (eg Participation, Death, Terminal Illness, Mental Incapacity and TPD and Trauma) can be addressed with insurance as a cheap funding mechanism in a separate Buy Sell Agreement. This can save a lot of their time, money and aggravation in the long term.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments